san antonio sales tax calculator

Divide tax percentage by 100 to get tax rate as a decimal. 0250 San Antonio ATD Advanced Transportation District.

The Florida sales tax rate is currently.

. Sales tax in San Antonio Texas is currently 825. The minimum combined 2022 sales tax rate for San Antonio Florida is. Counties cities and districts impose their own local taxes.

1000 City of San Antonio. While many other states allow counties and other localities to collect a local option sales tax Texas does not permit local sales taxes to be collected. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase.

This is the total of state county and city sales tax rates. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Florida are 200 cheaper than San Antonio Texas.

There is no applicable county tax. 0500 San Antonio MTA. San Antonio collects the maximum legal local sales tax.

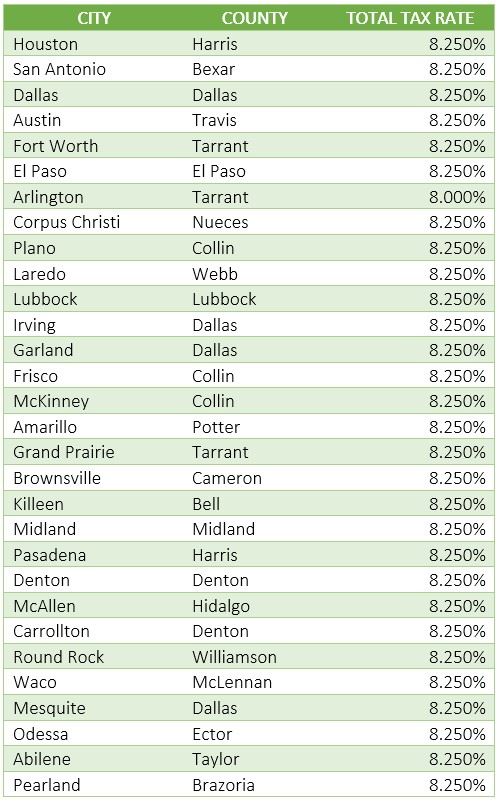

Method to calculate San Antonio Heights sales tax in 2021. Dallas Houston and San Antonio all have combined state and local sales tax rates of 825 for example. While Texas statewide sales tax rate is a relatively modest 625 total sales taxes including county and city taxes of up to 825 are levied.

The current total local sales tax rate in San Antonio FL is 7000. The sales tax rate for San Antonio was updated for the 2020 tax year this is the current sales tax rate we are using in the San Antonio Texas Sales Tax Comparison Calculator for 202223. The results are rounded to two decimals.

Real property tax on median. This is the total of state county and city sales tax rates. The San Antonio Texas sales tax is 625 the same as the Texas state sales tax.

The average sales tax rate in California is 8551. US Sales Tax Rates FL Rates Sales Tax Calculator Sales Tax Table. You can find more tax rates and allowances for San Antonio and Texas in the 2022 Texas Tax Tables.

Cost of Living Indexes. If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal. What is the sales tax rate in San Antonio Florida.

San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2. Find list price and tax percentage. San Antonio has parts of it located within Bexar County and Comal CountyWithin San Antonio there are around 82 zip codes with the most populous zip code being 78245As far as sales tax goes the zip code with the highest sales tax is 78201.

The San Antonio Sales Tax is collected by the merchant on all qualifying sales made within San Antonio. The San Antonio sales tax rate is. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375.

0125 dedicated to the City of San Antonio Pre-K 4 SA initiative. The sales tax rate does not vary based on zip code. For questions regarding your tax statement contact the Bexar County Tax Assessor-Collectors Office at.

The County sales tax rate is. San Antonios current sales tax rate is 8250 and is distributed as follows. San Antonio is located within Pasco County Florida.

What is the city tax for San Antonio Texas. This includes the rates on the state county city and special levels. The San Antonio sales tax rate is.

0125 dedicated to the City of San Antonio Pre-K 4 SA initiative. 0250 San Antonio ATD Advanced Transportation District. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax.

The Texas sales tax rate is currently. Remember that zip code boundaries dont always match up with political boundaries like San Antonio or Pasco County so you shouldnt always rely on something as imprecise as zip codes to determine. The minimum combined 2022 sales tax rate for San Antonio Texas is.

In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. Integrate Vertex seamlessly to the systems you already use. 1000 City of San Antonio.

The San Antonio Mta Texas sales tax is 675 consisting of 625 Texas state sales tax and 050 San Antonio Mta local sales taxesThe local sales tax consists of a 050 special district sales tax used to fund transportation districts local attractions etc. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The San Antonio Florida sales tax rate of 7 applies in the zip code 33576.

Wayfair Inc affect Texas. The County sales tax rate is. 0125 dedicated to the City of San Antonio Ready to Work Program.

Sales Tax State Local Sales Tax on Food. The December 2020 total local sales tax rate was also 7000. To make matters worse rates in most major cities reach this limit.

How to Calculate Sales Tax. The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide property tax billing and collection services for the City. Multiply the price of your item or service by the tax rate.

Sales Tax Calculator Sales Tax Table. This includes the rates on the state county city and special levels. Calculator for Sales Tax in the San Antonio.

Ad Manage sales tax calculations and exemption compliance without leaving your ERP. You can use our Texas Sales Tax Calculator to look up sales tax rates in Texas by address zip code. If this rate has been updated locally please contact us and we will update the sales tax rate for San.

Avalara provides supported pre-built integration. Sales and Use Tax. The average cumulative sales tax rate in San Antonio Texas is 822.

The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 San Antonio local sales taxesThe local sales tax consists of a 125 city sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc. 2022 Cost of Living Calculator for Taxes. US Sales Tax Texas Bexar Sales Tax calculator San Antonio.

The San Antonio Sales Tax is collected by the merchant on all qualifying sales made within San Antonio. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. 1000 City of San Antonio.

Did South Dakota v. San Antonios current sales tax rate is 8250 and is distributed as follows. The San Antonio Mta Sales Tax is collected by the merchant on all qualifying sales made within San Antonio Mta.

0125 dedicated to the City of San Antonio Ready to Work Program. Did South Dakota v. The December 2020 total local sales tax rate was also 8250.

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in San Antonio TX. 0125 dedicated to the City of San Antonio Ready to Work Program. The sales tax jurisdiction name is San Antonio Atd Transit which may refer to a local government division.

There are approximately 3897 people living in the San Antonio area. Fill in price either with or without sales tax. The average cumulative sales tax rate in San Antonio Florida is 7.

There is base sales tax by Texas. Ad Automate Standardize Taxability on Sales and Purchase Transactions. What is the city tax for San Antonio Texas.

Texas has a 625 statewide sales tax rate but also has 978 local tax jurisdictions including. San Antonio Texas and Pensacola Florida. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

Then use this number in the multiplication process. Within San Antonio there is 1 zip code with the most populous zip code being 33576. The current total local sales tax rate in San Antonio TX is 8250.

San Antonios current sales tax rate is 8250 and is distributed as follows.

How High Is Georgia S Corporate Tax Rate Atlanta Business Chronicle

Texas Sales Tax Guide For Businesses

Property Tax Calculator Casaplorer

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Texas County Challenge Texas County Map Texas County Texas Map

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

What Is The Austin Texas Sales Tax Rate The Base Rate In Texas Is 6 25

How To Calculate Taxes And Discounts Basic Concept Formulas And Examples Cuemath

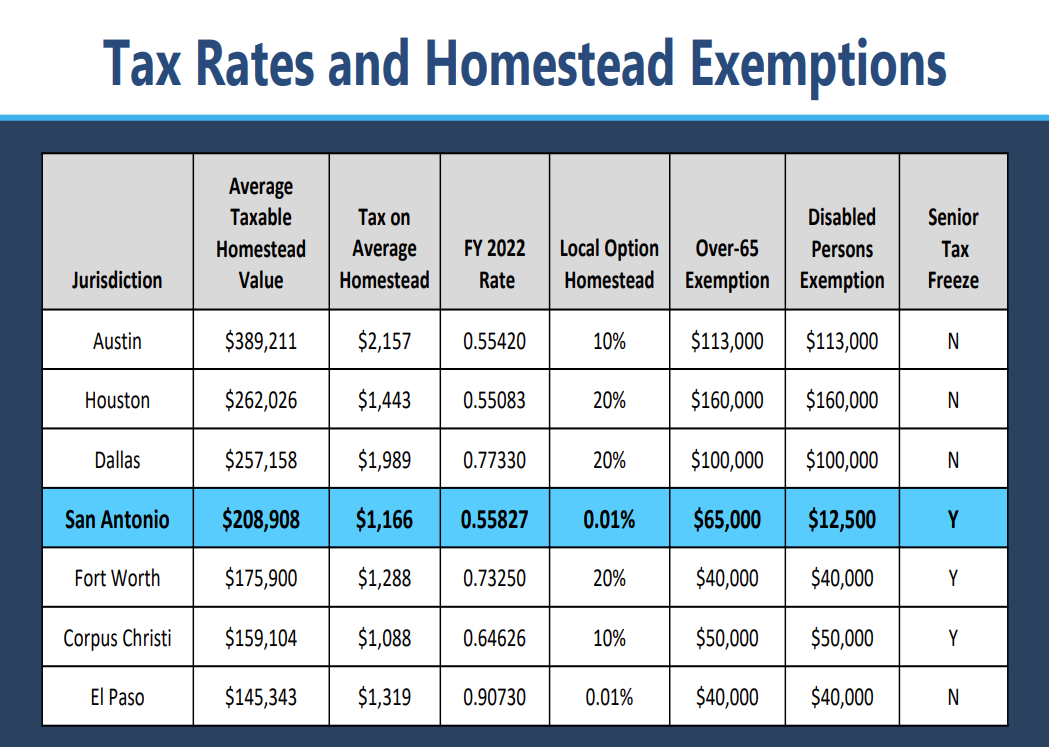

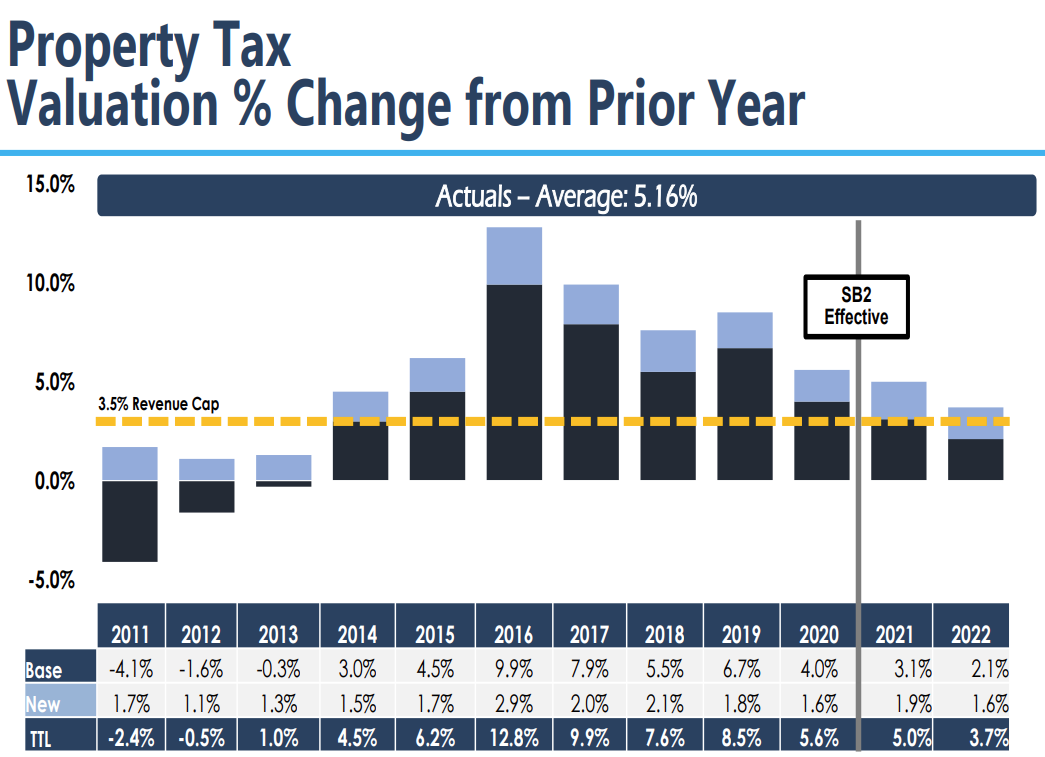

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Hotel Occupancy Tax San Antonio Hotel Lodging Association

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Texas Sales Tax Guide And Calculator 2022 Taxjar

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity